Hong Kong gets its own Fintech Index

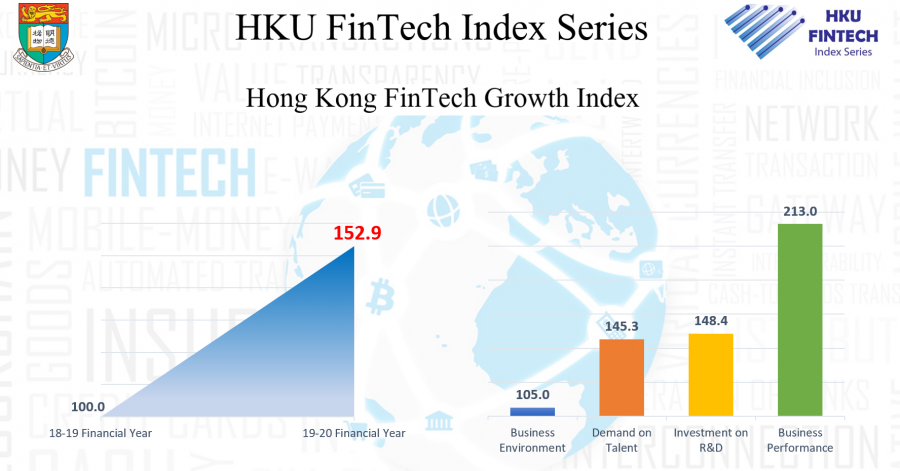

In a first initiative of its kind, HKU has launched two indices as part of the FinTech Index Series Project: the FinTech Growth Index (FGI) and the FinTech Buzz Index (FBI) to benchmark and forecast the state of FinTech in Hong Kong and also offer a framework for the wider Greater Bay Area.

While the FGI benchmarks industry performance, the FBI assesses media coverage around FinTech to measure public sentiment in Hong Kong. FGI, a yearly index, provides a reference for stakeholders like policy makers and business partners to help them make critical business decisions, says Dr. Yu from HKU’s Department of Statistics and Actuarial Science that led the project.

Dr Philip LH Yu, HKU Department of Statistics and Actuarial Science

“FGI is different,” says Dr. Yu, “It serves as an important indication to show market confidence and offers insights to investors and the government.”

Hong Kong is one of the world’s top 10 FinTech hubs and the biggest in its region. But so far it lacked any scientific benchmarks for stakeholders in FinTech to make critical business and policy decisions.

The new FGI represents responses from a robust pool of 38 companies working in the FinTech space – 84 per cent are startups, 11 per cent unicorns and 5 per cent traditional banks and insurance companies.

The index has four sub-indices: Business Environment, Business Performance, Investment on R&D or product development and Demand on Talent. Ratings for the 2019-2020 fiscal are benchmarked against a base of 100 points recorded in a survey the year before.

The Business Environment index for 2020 stood at 105 points, Business Performance at 213, Investment on R&D or product development 148.40 and Demand on Talent at 145.30.

At 105 points, the Business Environment index is sluggish and points to a need for a more effective policy and regulatory framework to support the FinTech sector.

A soaring Demand on Talent index (145.30 points) indicates companies are looking for talent with relevant skills and projects a growing job market. The top three skills expected of fresh talent are programming, marketing and knowledge of machine/deep learning and AI, Yu says.

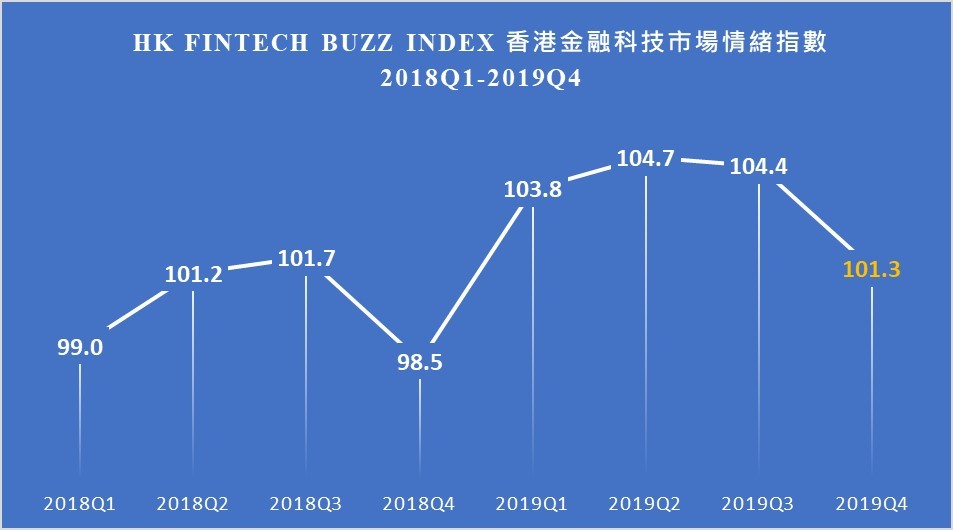

The FinTech Buzz Index (FBI) is a quarterly index that captures the quantified sentiment around Fintech in Hong Kong and uses nearly 10,000 news sources in Chinese.

"The top three skills expected of fresh talent are programming, marketing and knowledge of machine/deep learning and AI"

Dr Philip LH Yu, HKU Department of Statistics and Actuarial Science

“Hong Kong’s quarterly FinTech Buzz Indices in 2019 show values higher than 100, indicating an overall positive perception of the Fintech sector which boosts confidence for growth,” Dr. Yu says.

But in 2019 Q4, the index dropped quarter-on-quarter to 101.3, which could be because of the social unrest and political instability during this period in Hong Kong. In addition, the news articles also reflect an increasing level of concern by the general public about cybersecurity as well as possible risks associated with the soon-to-be-launched virtual banks.

38 companies are surveyed to arrive at the FinTech Growth Index. It comprises professionals from the University of Hong Kong and the local FinTech industry, including representatives from FinTech Association of Hong Kong, InvestHK, Cyberport, Science Park, and The Bank of East Asia, Limited.

The project is sponsored for a five-year period by big data and AI services and hardware company Suoxinda Data Technology Co. Ltd for a five-year period.

More information on the HKU FinTech Index Series Project is available at www.fintechindex.hku.hk.